Furniture Today features Pat Hayes, VP of Product Development and Marketing

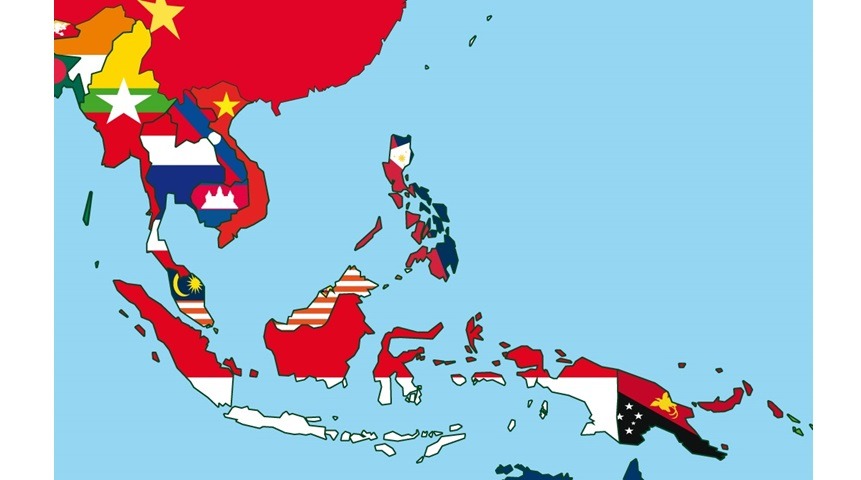

Optimism shines for Southeast Asia as strong alternative to Vietnam

Bobby Dalheim //Senior Editor of Case Goods and Global Sourcing//March 25, 2024

The Southeast Asian group of countries, primarily consisting of Malaysia, Indonesia, Thailand and the emerging Cambodia, continues to be a strong region for furniture sourcing, particularly for suppliers looking to fill gaps in product not best covered in Vietnam.

Each of these countries represents a different value for importers, with some having more potential than others.

Malaysia and Indonesia

“Out of any country, I personally believe it’s going to be Indonesia that stands to gain the most,” said Ken Shanks, president of Outlook International, which provides furniture sourcing expertise. “It has 200 million people or so, twice that of Vietnam. What has held it back is infrastructure. The cost of shipping out of there is still higher, but I think they’ll figure that out as it grows as an export country. Labor costs are low. Its population is younger than other nearby countries. It will have more time.

“The other thing it has is trees,” he continued. “I know factories in Indonesia that are growing millions of trees on plantations.”

Full home supplier Classic Home sources from a variety of countries, including Vietnam, Mexico, India, Indonesia and Malaysia.

“We do source from Indonesia for our Braxton Culler line,” said Matt Sorensen, vice president of sales. “That’s going to be where we source our wicker and rattan. It is really good at certain things like live-edge and root. Do I think it will be a player 10 years from now? Yes, but today it’s far from Vietnam and India.”

Malaysia has a reputation for being strong in lower price points and promotional product.

“Malaysia is great for starting price points,” said Sorensen. “But with our price points, we don’t really source much from there. Thailand, we’re looking at some items, but really both are low percentages. Most of what we get is from Vietnam and India.”

Martin Furniture imports entirely from Vietnam and Malaysia, with its cheaper product coming from Malaysia.

“All our wood product comes from Vietnam and our laminate comes from Malaysia,” said Pat Hayes, vice president of product. “The factory there suits us well, and there’s no reason for us really to move everything to Vietnam. Malaysia is great for promotional dining, but we’re not at that range.”

Bill Smith, vice president of business development and sales for CV International, a global logistics provider, agrees that Indonesia in particular is strong.

“Indonesia is another country (outside of Mexico and Vietnam) that I see is strong,” he said. “I know the population is large there and they have great natural resources. I’m not sure we see it increasing necessarily, but it’s steady and remains important. If it has increased, it could be due to the China shift. Malaysia is similar and is often lower-end goods.”

Thailand and Cambodia

Thailand is also improving, he said, noting the country has gotten considerably stronger in shipping. It was one of the worst countries to ship from over COVID, he said, citing equipment issues that have resolved now.

Cambodia was brought up by a few companies as having high potential. It’s the most hopeful spot for upholstery supplier Spectra Home.

“We have chosen to open a 2.5-million-square-foot facility in Cambodia because there are more workers willing to train and become skilled,” said Jim Telleysh, president. “Vietnam is having production issues with less workers and more sourcing moving to Vietnam.

“You will see Cambodia becoming a better sourcing region,” he continued. “Most shipping is going out of Ho Chi Minh from Cambodia, so the freight situation is good.”

As Telleysh suggests, part of the appeal of the region lies in the belief that Vietnam will eventually see a decline as it becomes more industrialized.

“If you look across Southeast Asia, starting with Vietnam and moving eastward, that whole region has the raw materials and the overall ingredients to become a center for furniture manufacturing,” said Pat Watson, vice president of product development at Martin Svensson. The region “has a semi-skilled workforce and it has political stability.”

Indonesia has the greatest upside of the region, said Watson, citing a large, growing population and an abundance of materials. One downside, though, is a risk of worker strikes.

“I don’t know if it’s still this way, but each province there sets their own labor rates,” he said. “You can have one labor rate for one other province and another for a different province. What would happen is workers of one province would go on strike for a higher rate, and your manufacturing would get messed up. When that would resolve, another would come up somewhere else.”

Media Contact:

Cheryl Whyers, Martin Furniture

Email: c.whyers@MartinFurniture.com